Understanding Mexico’s IMMEX Program: Unlocking Growth

Update Date: January 2026

Original Publication: May 6, 2024

Key Regulatory Changes (May 2024 – January 2026):

Late 2024 Changes

- October 14, 2024: 2nd Resolution of Amendments to Foreign Trade General Rules published

- November 14, 2024: Annex 24 changes effective (48-hour data transmission, real-time customs access)

- December 19, 2024: President Sheinbaum signed textile/apparel IMMEX restrictions decree

- December 30, 2024: General Foreign Trade Rules for 2025 published

2025 Changes

- January 6, 2025: Annexes 3-9, 11, 12, 14-21, 23-26, and 28-30 published; Annex 24 strengthened

- January 13, 2025: Plan México announced ($277 billion investment, IMMEX 4.0 promised)

- January 15, 2025: Ministry of Economy directive easing textile restrictions for compliant companies

- July 13, 2025: Textile exemptions expired

- August 29, 2025: US ended de minimis exemption (Section 321)

- September 9, 2025: Comprehensive customs and tariff reform proposals submitted to Congress

- November 19, 2025: Customs Law reform published in DOF

- December 10, 2025: Senate approved tariff law amendments (1,463 products affected)

Effective January 1, 2026

- Comprehensive Customs Law reform takes effect

- Tariff increases on 1,463 products (10-50%, averaging 35%)

- Stricter IMMEX controls codified into law

- Mandatory digital monitoring, biometric controls, AI systems

- Expanded joint liability for customs brokers and importers

- Penalties up to 250-300% of goods’ commercial value

- 24-hour discrepancy reporting requirement

- 60-day return deadline upon IMMEX cancellation now law

- Friday deadline for consolidated pedimentos (changed from Tuesday)

Updated Article

Mexico is a prominent player in international trade with its innovative policies designed to bolster exports and stimulate economic growth. One such initiative that has garnered attention is the IMMEX program. Launched to foster competitiveness and attract foreign investment, the IMMEX program has evolved into a vital tool for businesses seeking to operate in Mexico’s dynamic market. The program currently employs over 3 million workers in more than 5,000 certified operations throughout the country, with nearly 60% of IMMEX companies located along the U.S.-Mexico border zone.

In this comprehensive exploration, we delve into the history, provisions, benefits, and regulatory compliance requirements of the IMMEX program, shedding light on its significance in Mexico’s economic landscape.

Note: This article has been updated to reflect the significant regulatory overhaul implemented throughout 2024-2025 under the Sheinbaum administration, including the comprehensive Customs Law reform effective January 1, 2026, new Annex 24 requirements, textile import restrictions, enhanced compliance standards, and the Plan México industrial strategy.

Who is Eligible to Participate in Mexico’s IMMEX Program?

The IMMEX program (Maquiladora, Manufacturing, and Export Services Industry) in Mexico offers significant benefits to companies engaged in various industries, stimulating economic growth and international trade. Eligible companies span multiple sectors, including manufacturing, assembly, and export-oriented services. Manufacturing entities involved in electronics, automotive, aerospace, medical devices, textiles, food and beverages, and consumer goods are prime program beneficiaries. These companies leverage Mexico’s skilled labor force, strategic geographical location, and preferential trade agreements to enhance their competitiveness in global markets.

Additionally, service providers engaged in software development, engineering services, logistics, and technical support can participate in the IMMEX program, offering diverse services to international clients. Small and medium-sized enterprises (SMEs) may also participate and benefit from the program, gaining access to fiscal incentives to compete in international markets.

Critical 2024-2026 Update on Textile and Apparel Restrictions: In December 2024, certain finished textile and apparel products (HS Chapters 61, 62, and 63) were moved to Annex I of the IMMEX Decree, meaning they are prohibited from temporary importation under the program. While temporary exemptions were available through July 13, 2025 for compliant companies, these have now expired. The underlying tariff increases (finished textiles from 20-25% to 35%; inputs from 10% to 15%) remain in effect until April 23, 2026. Goods originating from USMCA countries (United States, Canada) remain exempt from these restrictions. Additionally, the November 2025 Customs Law reform restricts other finished goods (e.g., footwear) from IMMEX processing.

IMMEX participants undertake various activities within the manufacturing realm, including assembly, fabrication, and processing of raw materials or components into finished goods destined for export. Automotive manufacturers utilize Mexico’s robust supply chain infrastructure for vehicle assembly, while electronics companies capitalize on the skilled labor pool for device production. Aerospace firms manufacture aircraft components, benefiting from Mexico’s proximity to the United States, a significant aerospace market. Medical device manufacturers leverage Mexico’s regulatory framework and skilled workforce to produce surgical instruments, implants, and diagnostic equipment.

Origins and Evolution

The IMMEX program, short for “Industrial Manufacturing Maquiladora and Export Services Industry,” has its roots in Mexico’s efforts to attract foreign investment and promote economic growth. It emerged in the late 1960s and early 1970s as a response to the country’s desire to capitalize on its proximity to the United States, its largest trading partner, and leverage lower labor costs to enhance its competitiveness in manufacturing. The program was initially established to encourage foreign companies, primarily from the United States, to establish manufacturing operations in designated border regions known as maquiladoras.

The early stages of the program focused on allowing foreign companies to import materials and equipment duty-free for manufacturing purposes, with the condition that the finished products would be exported. This arrangement provided significant cost advantages for companies setting up operations in Mexico, leading to a boom in the maquiladora industry and contributing to job creation and economic development along the border.

Over time, the IMMEX program evolved in response to changing economic conditions and international trade dynamics. In the 1990s, Mexico underwent significant economic reforms, including signing the North American Free Trade Agreement (NAFTA) with the United States and Canada. In November 2006, Mexico introduced the current IMMEX Decree, consolidating the Maquiladora and PITEX programs to modernize and streamline operations. The program was further strengthened with the entry into force of the United States-Mexico-Canada Agreement (USMCA) in July 2020, which replaced NAFTA.

2024-2026 Regulatory Transformation

The transition to President Claudia Sheinbaum’s administration in late 2024 brought the most significant changes to Mexico’s customs and trade framework in three decades. On October 14, 2024, the government published amendments to the Foreign Trade General Rules, introducing sweeping changes to Annex 24 inventory control requirements effective November 14, 2024.

On December 19, 2024, President Sheinbaum signed a presidential decree imposing restrictions on temporary imports of textile and apparel products, citing the need to protect Mexico’s domestic textile industry, which had experienced approximately 79,000 job losses and a 4.8% GDP contraction in 2024. Economy Secretary Marcelo Ebrard stated that the IMMEX program was designed for intermediary goods and that some companies had been abusing it by selling finished goods directly into Mexico rather than re-exporting them.

On January 13, 2025, President Sheinbaum announced “Plan México,” a comprehensive national strategy comprising 13 goals and a portfolio of investments totaling $277 billion USD over six years. The plan aims to position Mexico among the world’s top ten economies by 2030 through import substitution, increased domestic content, and investment in eight priority sectors. As part of this plan, the government announced an “IMMEX 4.0” program intended to integrate and streamline tax certifications, though no concrete legal instrument implementing this promise had been published by late 2025.

The November 2025 Customs Law Reform: On September 9, 2025, the federal executive submitted comprehensive customs and tariff reform proposals to Congress as part of the 2026 Economic Package. These were approved and published on November 19, 2025, representing the first major overhaul of Mexico’s customs framework since 1995. The reform, effective January 1, 2026, introduces higher import duties for 1,463 tariff items (averaging 35%, up to 50% in some cases), mandatory digital traceability, biometric controls, AI-based risk assessment systems, and significantly expanded liability for all parties involved in customs operations. The government projects this will increase customs revenue from approximately MXN 151.7 billion in 2025 to MXN 254.7 billion in 2026.

Provisions and Benefits

The IMMEX program is a strategic initiative implemented by the Mexican government to boost the country’s manufacturing sector and stimulate economic growth. This program offers numerous provisions and benefits to companies engaged in manufacturing activities within Mexico.

One of the key provisions of the IMMEX program is the ability for companies to temporarily import raw materials, components, and equipment duty-free, as long as they are used in the manufacturing process for export. Temporarily imported raw materials may remain up to sixteen (16) months before needing to be exported. This provision significantly reduces production costs for participating companies, making them more competitive globally.

Companies operating under the IMMEX program are granted preferential tax treatment through deferral of import taxes and duties. However, the Value Added Tax (VAT) of 16% must still be paid on imported products unless the importer also obtains registration in the Business Certification Scheme (VAT and IEPS modality), which permits obtaining a tax credit for the VAT upon importation. When paired with VAT certification, which is renewed annually, manufacturers benefit from the VAT exemption for significant cost savings.

Updated VAT Certification Requirements (2024-2025): Companies that temporarily import or intend to temporarily import sensitive goods under their IMMEX program must now return at least 80% of the total value of the temporary imports made during the last 12 months (increased from the previous 60% requirement). The bond or guarantee period has been extended from a maximum of 24 months to 30 months, with renewal applications now required during the first 10 days after the initial 12-month period. Personnel must be linked to the productive or service process, and companies must grant customs authorities remote access to their automated inventory control systems.

Another significant benefit of the IMMEX program is the flexibility it provides regarding labor regulations. Participating companies can hire foreign personnel, subject to certain conditions, to meet specific labor needs. The program also encourages the development of local suppliers and fosters technology transfer, leading to additional employment opportunities and overall economic development.

There are also tax incentives for companies operating within the northern and southern border zones, including a reduced VAT rate of 8% (a 50% credit on the standard 16% rate) and reduced income tax obligations. The “Plan México” nearshoring incentives announced in January 2025 include approximately $1.5 billion USD in tax incentives over six years to support companies investing in Mexico as part of supply chain relocation in strategic sectors including semiconductors, automotive (especially electric vehicles), pharmaceuticals, and aerospace.

Customs Clearance Simplification and Inventory Control

Mexico’s IMMEX Program significantly simplifies customs clearance and inventory control processes for companies engaged in manufacturing activities. The National Customs Agency of Mexico (ANAM), established following the October 2024 constitutional reform, is now responsible for inspecting goods entering and leaving Mexico.

Streamlined Customs Procedures: IMMEX participants benefit from streamlined customs procedures, which expedite the import and export processes. Companies are granted access to specialized customs lanes or fast-track clearance processes. However, as of January 2026, the Customs Law reform introduces stricter timelines: consolidated pedimentos must now be submitted no later than each Friday (covering Monday to Sunday operations), replacing the previous Tuesday deadline.

Virtual Inventory Control: One of the key features of the IMMEX Program is the concept of “virtual inventory control.” Under this system, companies can temporarily import raw materials, components, and equipment duty-free for manufacturing. These imported materials are considered part of the company’s virtual inventory and are not subject to immediate taxation or duties until the finished products are exported.

Annex 24 Requirements (Updated through 2025): Annex 24, strengthened through amendments published in October 2024 and January 2025, plays an essential role in managing IMMEX operations. Certified companies registered in the Business Certification Scheme must maintain an automated inventory control system that electronically transmits specific data within 48 hours following customs clearance. Companies must grant online access to their inventory control system to customs authorities in real-time by submitting a written request indicating the username and password for access. The Annex 24 software must include all general taxpayer information, customs declarations, descriptions of materials and their usage, and reporting requirements. Non-compliance can result in fines and cancellation of IMMEX Program authorization.

January 2026 Digital Controls: The November 2025 Customs Law reform introduces a technologically integrated customs system with mandatory biometric controls, electronic seals, AI-based risk assessment, and big data analytics. Companies must strengthen documentation across their international logistics chains, and discrepancies must be reported to SAT within 24 hours of arrival (reduced from previous timelines). Mexican importers are now required to verify that foreign suppliers have both legal and physical capacity to supply goods before the transaction.

Bonded Warehousing: IMMEX participants can operate bonded warehouses (“recinto fiscalizado”) within Mexico, allowing companies to store imported materials duty-free until needed for production. However, under the 2026 reform, reduced storage times and expanded verification procedures may affect logistics planning.

Trend Towards Relacating Manufacturing to North America

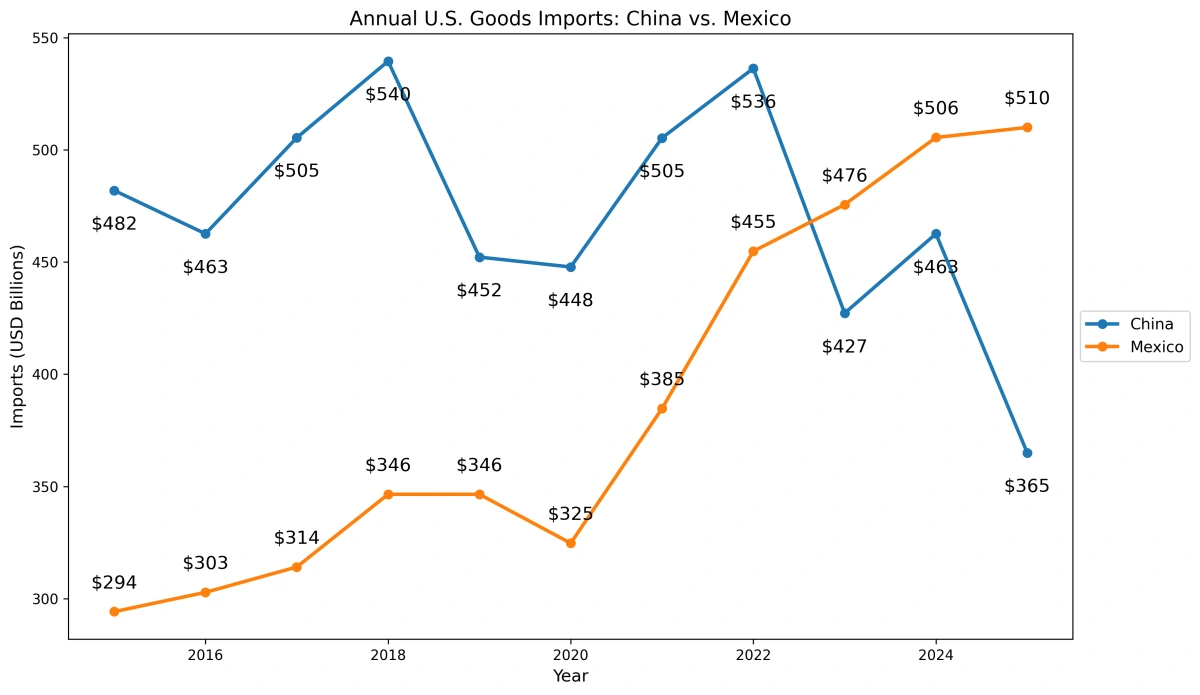

This chart illustrates a clear structural shift in U.S. goods imports over the past decade. While imports from China peaked in the late 2010s and have since declined, imports from Mexico have risen steadily and now exceed those from China. The divergence underscores a strong and sustained trend toward relocating manufacturing and supply chains closer to the U.S. market—particularly to Mexico—driven by nearshoring, trade policy, supply-chain resilience concerns, and cost competitiveness within North America.

Promoting Exports and Job Creation

The IMMEX program in Mexico plays a pivotal role in promoting exports and job creation for Mexican workers. The program has been remarkably successful: by incentivizing manufacturers to export goods, IMMEX led to a 99% increase in export trade in just over a decade, from $210 billion in 2005 to $419 billion in 2017. Mexico became the United States’ top trading partner in 2023, and IMMEX companies account for approximately 85% of Mexico’s manufactured exports.

Export-Oriented Manufacturing: The primary objective of the IMMEX program is to encourage export-oriented manufacturing activities. By allowing companies to import raw materials, components, and equipment duty-free for use in manufacturing processes destined for export, the program incentivizes companies to produce goods for international markets. About three-quarters of Mexico’s exports go to the United States.

Job Creation: The IMMEX program currently employs over 3 million workers, with about 35% of all manufacturing employees in Mexico working in IMMEX companies. The Plan México strategy announced in January 2025 aims to generate an additional 1.5 million jobs through its investment incentives and industrial development initiatives.

Supplier Development and Technology Transfer: The IMMEX program encourages participating companies to develop local supplier networks and engage with domestic suppliers. The Plan México strategy explicitly targets import substitution to increase national and regional content, with goals such as 50% domestic content in finished textile products and a 15% reduction in imported sewing thread. Many companies participating in the IMMEX program bring advanced technologies and manufacturing expertise to Mexico, enhancing worker skills and productivity.

Regulatory Compliance Requirements

The regulatory compliance requirements of the Mexican IMMEX program are designed to ensure that participating companies adhere to established rules and regulations. These requirements have been substantially strengthened through the 2024-2025 reforms and the January 2026 Customs Law changes.

Registration and Authorization: Companies must register with the Mexican government and obtain authorization from the Secretariat of Economy (SE). The authorization requires a commitment to have annual sales abroad of at least US$500,000 or invoice exports accounting for at least 10% of total invoices. Companies must submit an annual electronic report of total sales and exports for the preceding tax year no later than the last business day of May.

Inventory Control and Reporting (2024-2026 Requirements): IMMEX participants must implement robust inventory control systems to track the movement and usage of imported materials and equipment. As of November 2024, companies certified under the Business Certification Scheme must maintain an automated inventory control system (Annex 24) that electronically transmits data within 48 hours and provides real-time online access to customs authorities. The 60-calendar-day period to return temporarily imported goods or change their regime in the event of program cancellation is now codified into law as of January 2026, with immediate tax credits generated upon non-compliance.

Compliance with Tax and Customs Regulations: IMMEX companies must comply with Mexican tax and customs regulations. VAT payments on temporary goods can only be exempted if the taxpayer has both IMMEX Program certification and VAT Certification. Under the 2026 reform, importers must ensure the accuracy of all information provided to their customs broker, since both parties are now legally responsible for declaration errors (expanded joint liability).

Compliance Audits and Inspections: The Mexican government conducts periodic audits and inspections of IMMEX participants. The General Administration of Foreign Trade Auditing (AGACE) personnel may conduct inspections. Under the 2026 reform, customs brokers must conduct comprehensive know-your-customer (KYC) due diligence, confirm clients are not on SAT’s blacklist, and verify that importers/exporters have necessary physical and systems infrastructure. Companies found to be non-compliant may face severe penalties.

Enhanced Penalties (Effective January 2026)

The November 2025 Customs Law reform introduces substantially increased penalties for IMMEX and related companies:

- Prohibited imports: Fines of 250-300% of the goods’ commercial value

- Non-compliance with non-tariff measures: Fines of 250-300% of commercial value

- Inaccurate data on supplier identity: Fines up to 300% of goods’ value plus possible revocation of licenses

- All administrative fines: Imposed in addition to applicable customs duties, taxes, surcharges, and do not preclude seizure or forfeiture

The government projects customs revenue to increase from approximately MXN 151.7 billion in 2025 to MXN 254.7 billion in 2026, with a significant portion expected from audit and inspection procedures.

Enhanced Enforcement (2024-2026)

The Sheinbaum administration has intensified enforcement against companies abusing the IMMEX program, which the government refers to as “technical smuggling.” Key areas of scrutiny include:

- Failing to re-export goods: Companies selling duty-free imports domestically rather than exporting them

- Misclassifying goods: Manufacturers misclassifying high-duty items to avoid tariffs

- Third-party shelter company abuse: 3PLs operating under shelter companies without proper oversight

- Concealing country of origin: Companies handling goods from non-FTA countries without proper documentation

- Shell entities: The 2026 reform targets tax evasion through stricter traceability and verification of legal existence

For US shippers and manufacturers using IMMEX, it is crucial to work with partners that are directly certified under IMMEX, ensure complete documentation and country-of-origin verification, and verify compliance with all program requirements. Under the 2026 rules, customs brokers must verify that clients have assets and infrastructure needed to carry out their operations.

Do You Need Help With Manufacturing in Mexico?

Our team of seasoned manufacturing in Mexico specialists is ready to understand your unique needs and craft a tailor-made plan to optimize your production needs. We offer a comprehensive suite of manufacturing solutions, in our multiple locations in Mexico. Let’s unlock the full potential of your manufacturing process. We’ll guide you every step of the way. Contact us for a complimentary consultation.

Conclusion

Mexico’s IMMEX program stands as a testament to the country’s commitment to fostering economic growth, attracting foreign investment, and promoting international trade. From its origins in the late 1960s to the comprehensive 2024-2026 regulatory transformation, the program has continuously evolved to address new challenges while remaining a cornerstone of Mexico’s trade strategy.

The 2024-2026 reforms represent the most significant changes to Mexico’s customs framework in three decades, reflecting the Sheinbaum administration’s emphasis on import substitution, industrial strengthening, and tighter customs enforcement under the “Plan México” strategy. While these changes introduce substantial new compliance burdens—including stricter inventory controls, expanded liability, digital monitoring requirements, and significantly increased penalties—the IMMEX program remains a vital tool for industries including automotive, aerospace, electronics, and medical devices.

Companies considering or currently operating under IMMEX should prioritize compliance with the January 2026 Customs Law requirements, including enhanced documentation, real-time inventory system access for authorities, and verification of foreign supplier legitimacy. Working with experienced shelter companies or compliance partners has become increasingly important given the expanded liability framework and the government’s aggressive enforcement posture.

In essence, the IMMEX program remains essential for unlocking growth and creating opportunities in Mexico’s manufacturing sector—but success now requires a proactive compliance approach, stronger documentation practices, and close attention to the rapidly evolving regulatory landscape.

Streamline Your Manufacturing with Mexico’s IMMEX Program

Prince Manufacturing is a proud IMMEX authorized company, positioned to simplify your manufacturing operations in Mexico. Leverage the program’s duty-free temporary imports and gain a significant cost advantage.

Unlock the Potential of IMMEX: Our team of IMMEX specialists is here to guide you through the entire process, including the new 2026 compliance requirements. We’ll assess your needs, ensure program eligibility, navigate the application seamlessly, and help you maintain compliance with Annex 24, VAT certification requirements, and the new Customs Law obligations.

Contact Us Today: Don’t miss out on the benefits of IMMEX. Partner with Prince Manufacturing and unlock a world of manufacturing efficiency in Mexico. Contact us now to discuss your specific requirements.

About the Author

Iram Chavez, President & CEO

Iram has held executive leadership positions at Prince during his long tenure. Previously VP of Operations. Iram’s career exemplifies professional expertise in Operations Management, working with world-class companies such as Emerson Electric, General Motors, AVX, Delphi Automotive, and, of course, Prince Manufacturing. Iram has held key positions in the areas of Engineering, Manufacturing, Project Management, and Operations.

During his career, he has successfully completed different assignments throughout the US and Mexico. A native of Delicias, Chihuahua, Mexico; Iram earned a Bachelor’s degree in Mechanical/Industrial Engineering from Chihuahua Technological Institute in 1994 and Master’s degree in Business Administration from the University of Texas at El Paso in 2012.